CPS 230

Prepare your institution to

become CPS 230 compliant

Let RobobAI help your financial institution become CPS 230 compliant using AI-driven operational risk management software.

With the new CPS APRA regulations almost here, leaders within APRA-regulated institutions need to be mindful of how their systems must change to comply.

The new regulations aim to streamline operational risk for APRA-regulated institutions. They bring major change to the industry and put even more accountability on institutions to avoid operational risk at all costs.

For your institution, the new regulation will necessitate restructuring systems and reframing how employees and teams work with third-party suppliers and providers.

That’s where RobobAI can help.

Data-driven risk management software

RobobAI offers specially crafted, data-driven CPS 230 software that can help your financial institution streamline data to meet CPS 230 regulatory requirements.

With a focus on minimizing operational risk in supply chains, RobobAI offers system-wide compliance structures that will give the best possible vantage point to snuff out any potential security threat. Whether you need to simply connect the dots between existing data or build a ground-up CPS 230-compliant system to manage your operational risks, RobobAI is here to help.

RobobAI offers innovative AI-powered software that:

- Gives you a 360° view of your spend data to help you define materiality and identify material suppliers across your supply chain

- The ability to apply third-party risk filters to monitor and identify third-party supplier risk

- Engage with your material suppliers in real time to track, manage, and mitigate compliance risks

- Uses tailored questionnaires to capture and monitor fourth-party service providers for additional control

RobobAI’s CPS 230 operational risk management software gives you a better understanding of third-party supplier risk and the best way to mitigate it. Whether it be cyber, financial, or legislative, RobobAI can put your financial institution in the best position to mitigate risk and maintain ongoing compliance.

Optimizing the upside with AI

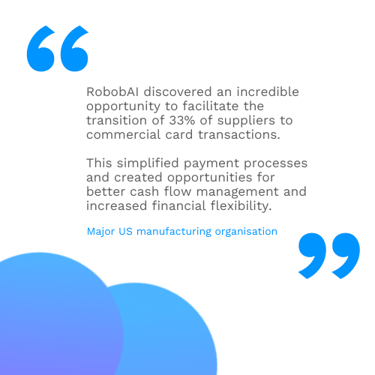

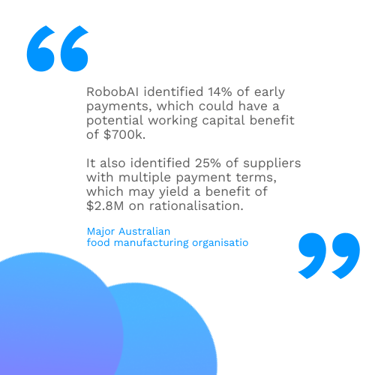

Where there is change there is also opportunity. RobobAI technology analyses spending to identify not just risk, but also the potential for growth and savings within complex supply chains. The use of AI-assisted software leads to continuous data improvement and:

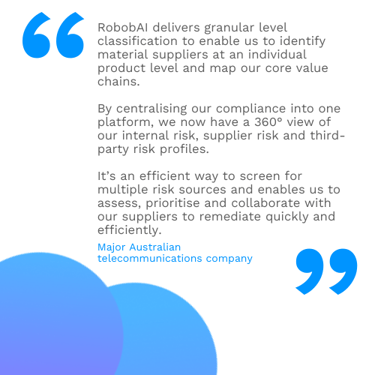

What our clients say

Now is the time to act on CPS 230

APRA expects financial institutions to test their CPS 230-compliant systems for six months ahead of the 1 July 2025 start date. The changes called for by these new regulations will take time to implement, and institutions will likely face hiccups along the way to compliance.

The time to start making those changes is now.

Want to learn more about how RobobAI can help with CPS APRA compliance?

Request a demonstration now.

-1.png)

.png)

.png)